When vehicles are used for both personal and business purposes, the taxpayer may take deductions only for the percentage of use attributable to the business. Nor can the standard mileage rate be used if the owner has taken an IRC § 179 or other depreciation deduction for the vehicle.

Taxpayers that operate five or more cars or light trucks at the same time are not eligible to use the standard mileage rate. The standard mileage rate for 2019 is 58 cents per mile (57.5 cents in 2020). (See Depreciation section below for rules for depreciating various vehicles used in the farm business). Farmers choosing this method must keep good records of these expenses.

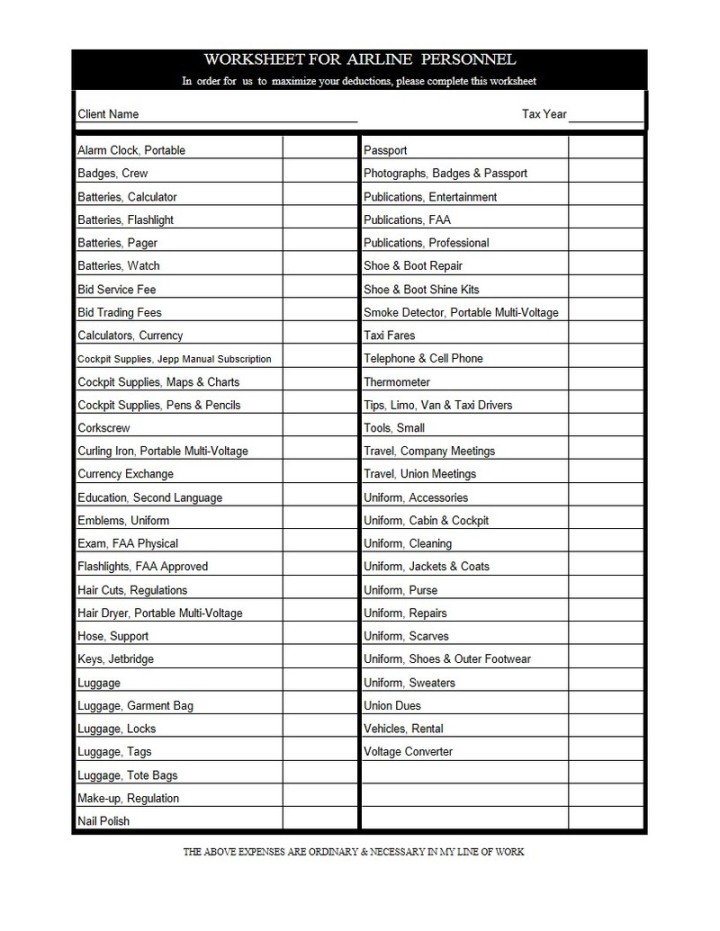

#Tax deductible expenses list license#

These include gasoline, oil, repairs, license tags, insurance, and depreciation (subject to certain limits). Those taxpayers who choose the actual cost method may deduct those expenses related to the business use of the vehicle. Car and Truck Expensesįarmers, like other business owners, have the option to either (1) deduct the actual cost of operating a truck or car in their business or (2) deduct the standard mileage rate for each mile of business use. Following is a summary of several key expense deductions for farmers. Those properly deductible expenses not separately listed on the Form are reported on line 32. Schedule F itemizes many of these expenses in Part II. In agriculture, these ordinary and necessary expenses include car and truck expenses, fertilizer, seed, rent, insurance, fuel, and other costs of operating a farm. in carrying on any trade or business.” IRC § 162. Farmers, like other business owners, may deduct “ordinary and necessary expenses paid.

0 kommentar(er)

0 kommentar(er)