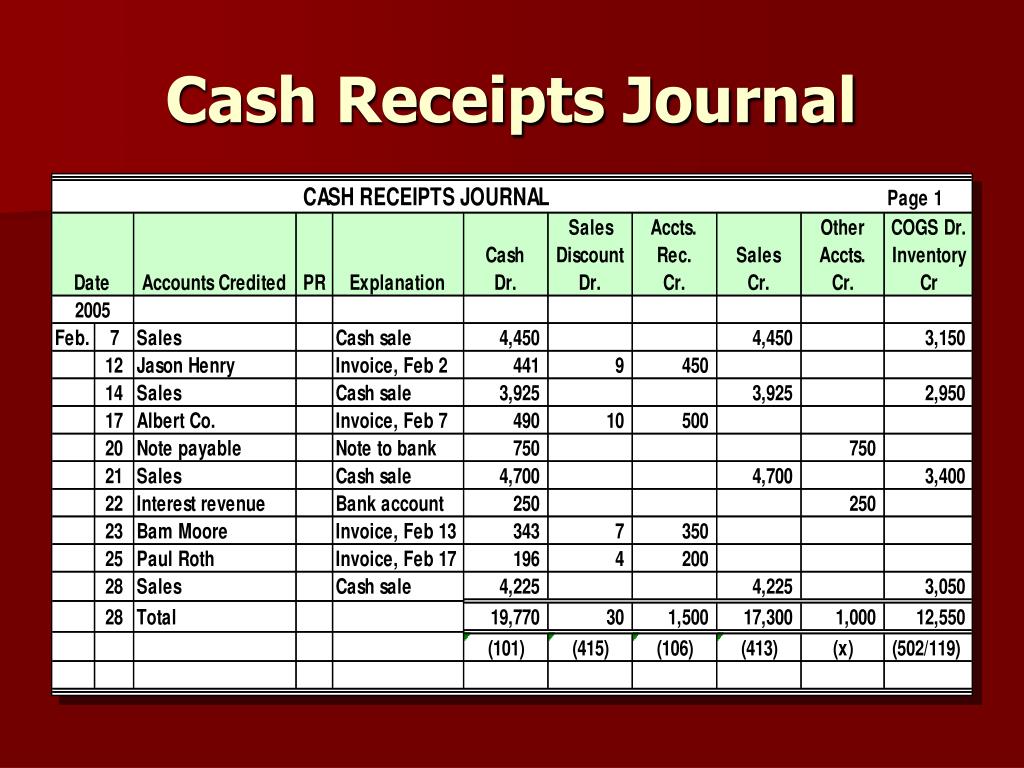

- CASH RECEIPTS JOURNAL SERIAL NUMBER

- CASH RECEIPTS JOURNAL PRO

- CASH RECEIPTS JOURNAL VERIFICATION

- CASH RECEIPTS JOURNAL FREE

CASH RECEIPTS JOURNAL VERIFICATION

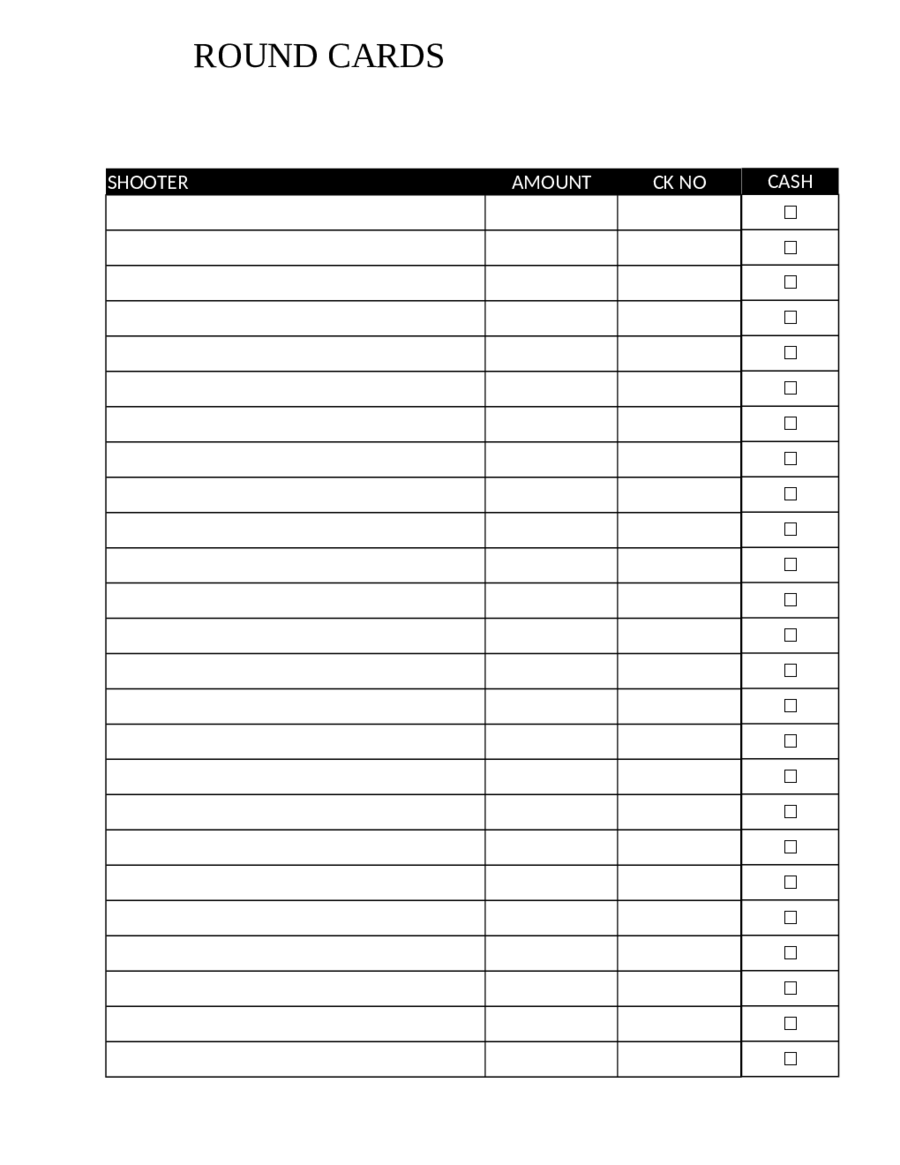

The records can be proved as verification of cash at any point in time.The contents of the cash receipt are clear and unambiguous, which helps to track the records and find out the remaining balance receivable or payable by the organization.Cash receipt is one of the primary documents maintained by every organization.The issuance of a cash receipt voucher enforces the issuer to maintain the records correctly, and it reduces the chances of misappropriation.The cash receipt voucher contains the details of the payer so that in case of any discrepancies payer can be easily traced.With the issuance of cash receipts and payment vouchers and deflection can be traced.It helps in keeping records of cash received and cash paid.A cash Receipt voucher is a legally enforceable document.also issued the cash receipt voucher as proof of clearance of debt as below: Z’s authorized person cleared the payment and issued the cash payment receipt and signed it and get signed it by the agent of ABC & Co. Z’s organization, and after verifying the bill Mr. The agent presented the bill to the authorized person of Mr. Z to collect the debt against the bill in cash. After one month, the collection agent of ABC & Co. Z didn’t pay the bill immediately and promised to pay the bill after one month. Mode of payment, whether cash, cheque, or online transfer to be written on cash receipt voucher.ĪBC & Co.Cash receipt also contains the signature of the receiver so as to know that the authorized person is receiving the cash.whether cash is received against a loan or against sales, etc., with details to be written to keep track of various records.

The purpose of receiving the cash, i.e.Name of the payer and the name of the business organization of the payer must be written on the cash receipt.

CASH RECEIPTS JOURNAL SERIAL NUMBER

CASH RECEIPTS JOURNAL FREE

Start Your Free Investment Banking Courseĭownload Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others Characteristics of Cash Receiptįollowing are the characteristic of Cash Receipt: Some prefer detailed records, while others prefer summary receipts.

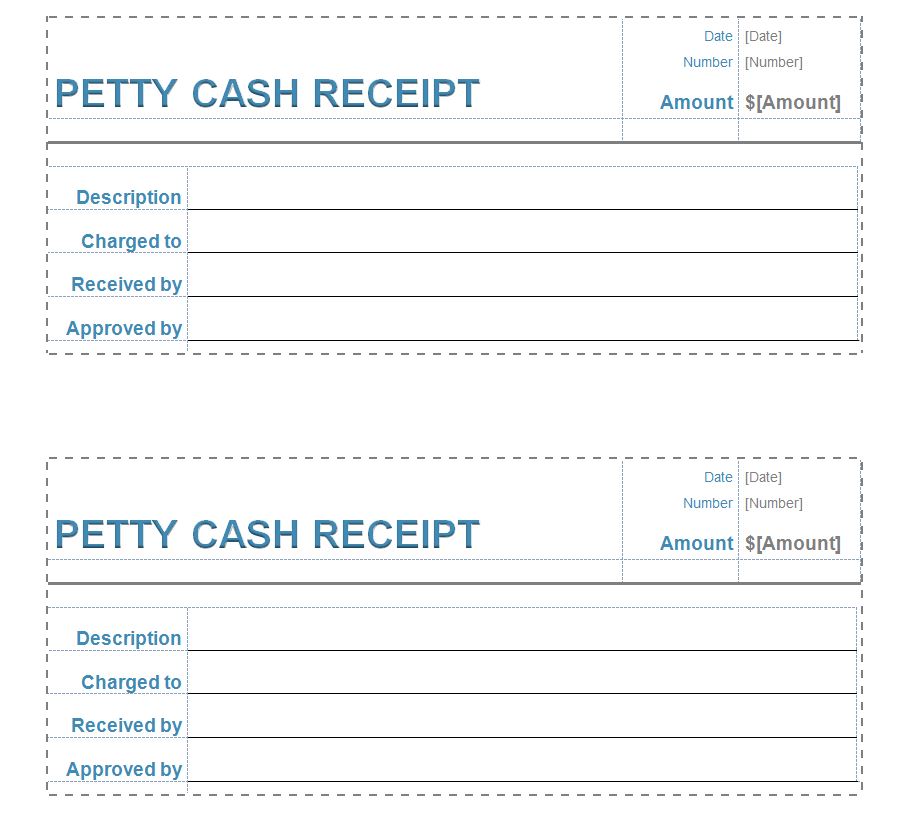

CASH RECEIPTS JOURNAL PRO

The pro forma for cash receipts varies from organization to organization. Hence maintenance of records in the form of cash receipts is very important and necessary. As cash is an important item for every business, the chances of teaming & leading and other frauds become the more. Against every cash receipt, the business organization generates a formal document called a ‘cash receipt’ to record the transaction.

Examples of cash receipts are receipts from debtors, banks, etc. Cash transactions in the business occur in the form of receipts and payments.

Hence it is necessary to make a record of cash so as to verify and present the true picture of the business. ExplanationĪ business organization has to perform many functions like management of inventory, investors, debtors, etc., for all the management, cash is primarily used in business. In simple terms, a cash receipt is the official document of receipt of cash from external sources like receipts from debtors, receipts from a bank, and receipts as loans from third parties, etc., and in order to formalize the transaction, cash receipts are generated and can be presented as the proof of amount receivable.

0 kommentar(er)

0 kommentar(er)